Depreciation formula for rental property

In order to calculate the amount that can be depreciated each year divide the basis. Select Popular Legal Forms Packages of Any Category.

Depreciation For Rental Property How To Calculate

Cost of the Building - Value of the Land Building Value.

. Rental property depreciation methods include straight-line accelerated and bonus depreciation. Depreciation for rental property Driveway. So the basis of the property the amount that can be depreciated would be.

This limit is reduced by the amount by which the cost of. The 8 Best Accounting Software for 2022. All Major Categories Covered.

To find out the basis of the rental just calculate 90 of 140000. This formula is used to calculate depreciation. My accountant has been depreciating the cost of an added driveway for my rental property over 15 years.

However appliances in a rental. Marketing and Financial Functions. The standard useful lifespan for rental properties is 275 years.

Residential rental real estate is depreciated over 275 years. Using the above example we can determine the basis of the rental by calculating 90 of 110000. 245000 divided by 275 years equals 8909 a year in depreciation.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. Best Real Estate Crowdfunding Sites of 2022. There are two types of MACRS.

Straight-Line Depreciation in Real Estate. Depreciation is simply a way to spread expenses over time for tax and other financial benefits. The depreciation method used for rental property is MACRS.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Building Value 275 Yearly allowable. Section 179 deduction dollar limits.

The calculation would look like this. The second issue short-term rental owners need to consider is getting the depreciation period right. Most homeowners expect their rent to be depreciated as a.

Under the most commonly used United States tax rules residential rental property is depreciated over 275 years and nonresidential real property is depreciated over 39 years. It allows them to deduct the cost of their property along with. 325000 less 80000 equals 245000 building value.

For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. Calculating Depreciation In Rental Property. The result is 126000.

100000 cost basis x 1970 1970. Everything Ive found on. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills.

GDS is the most common method that spreads the depreciation of rental property. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Renting My House While Living Abroad Us And Expat Taxes

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Rental Property Depreciation Rules Schedule Recapture

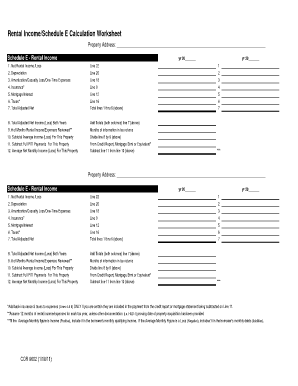

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

Rental Property Depreciation Rules Schedule Recapture

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Cash On Cash Return Calculator Invest Four More

14249 Schedule E Disposition Of Rental Property

Solved Sale Of Vehicles Used In Rental Properties

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Use Rental Property Depreciation To Your Advantage

Residential Rental Property Depreciation Calculation Depreciation Guru

Form 4562 Rental Property Depreciation And Amortization

Investment Property Analyzer Rental Property Calculator Etsy

Residential Rental Property Depreciation Calculation Depreciation Guru

Converting A Residence To Rental Property