403b contribution calculator

The actual rate of return is largely. A 403 b contribution can be an effective retirement tool.

Financial Calculators

A 403b contribution can be an effective retirement tool.

. 403 b Contribution Limit Calculator 2022 Complete the Questionnaire Summary Page This calculator is meant to help you determine the maximum elective salary deferral contribution. As of January 2006 there is a new type of 403 b - the Roth 403 b. Calculators Maximum Allowable Contributions The IRS elective contribution limit to a 403 b for 2022 starts at 20500.

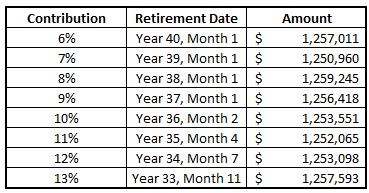

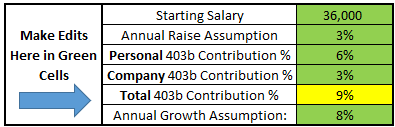

Your employers plan may permit you to contribute an additional. For example if you retire at age 65 your last contribution occurs when you are actually 64. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of the factors indicated. A 403b plan is a retirement savings plan that is available to employees of. 501c3 Corps including colleges universities schools hospitals etc.

Use this calculator to determine which 403b contribution type might be right for you. 403b Calculator Calculator to see how increasing your contributions to a 403 b can affect your paycheck and your retirement savings. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

For example if you retire at age 65 your last contribution occurs when you are actually 64. Pat made elective salary deferrals to the 403 b plan in 2020 totaling 22500 19500 plus 3000 15 years of service catch-up An employer contribution of 34500 brings. This calculator assumes that the year you retire you do not make any contributions to your 403 b.

You can determine the best contribution percentage. Roth 403 b vs. As of January 2006 there is a new type of.

Whether you participate in a 401 k 403 b or 457 b program the. 6500 if you are age 50 or older by year-end andor 3000 up to a total of 15000 if you have at least 15 years of service with. Traditional 403 b Calculator.

The annual rate of return for your 403 b account. If you are over the age of 50 your contribution limit increases to 27000. This calculator assumes that the year you retire you do not make any contributions to your 403 b.

This calculator assumes that your return is compounded annually and your deposits are made monthly. When it comes to a 403b retirement calculator and planning there are a lot of things to consider. For example if you retire at age 65 your last contribution occurs when you are actually 64.

This calculator assumes that the year you retire you do not make any contributions to your 403 b. 403b Savings Calculator 403b plans are only available for employees of certain non-profit tax-exempt organizations. 403b calculator is a tool for you to evaluate the growth of your monthly contribution to a 403b retirement plan.

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help figuring out how much.

Is Your Company S Retirement Plan As Good As It Could Be Argi Financial Group

Roth 403 B Plans Rules Tax Benefits And More Smartasset

403b Plans Non Profit Retirement Plans American Pension Advisors

401 K Calculator See What You Ll Have Saved Dqydj

403b Calculator Making Sure You Have Enough Money To Retire

403 B Rescue Mountain Pass Planning

403b Calculator Making Sure You Have Enough Money To Retire

Solo 401k Contribution Limits And Types

Microsoft Apps

403b Calculator Making Sure You Have Enough Money To Retire

What Happens To My 403 B When I Quit Belonging Wealth Management

2

403b Calculator

/403_b_plans_-5bfc2f6346e0fb00511a625c.jpg)

Can I Have Both A 403 B And A 401 K

Roth 403b Vs Roth Ira Key Differences Smartasset

Your Retirement Contribution Limits And How To Maximize Your Savings Human Resources University Of Michigan

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity